Entropay Alternative

Entropay Alternative Rating: 6,5/10 7675 reviews

Entropay is no longer available as of 1st July 2019. Visit our Payment Methods page to find alternatives.

Entropay is a prepaid virtual Visa card that enables Canadian online casino players to fund their accounts securely and which is also easy and convenient to use. Accounts can be operated across fourteen different currencies (including CAD$) and deposits made using Entropay are credited to your casino account instantaneously.

There are more than 25 alternatives to Entropay, not only websites but also apps for a variety of platforms, including Android, iPhone, Windows and iPad. The best alternative is PayPal. It's not free, so if you're looking for a free alternative, you could try Amazon Pay or Skrill. Entropay Closing Down - Alternative Services Last year in December, Entropay announced to their users that their service was going to be limited in February 2019. First, virtual Visa cards couldn't be topped up anymore and the balance was going to be transferred to the e-wallet. Entropay alternative? MikeOf LBuzzard Posts: 430. Forum Member 05/03/19 - 16:25 in Online Entertainment Services #1. Now Entropay has ceased effectively trading has anyone found as good a site for virtual cards? Hope this doesn’t break any rules but you can send me private message if necessary.

See our list detailing the top Canadian casinos accepting Entropay as both a deposit and withdrawal method below

Advantages of using Entropay as a deposit method

There are a number of advantages for Canadian players in using Entropay as a virtual visa card to fund an online casino account.

Anonymity: The main advantage of using Entropay is the anonymity it provides. Your transactions with your online casino do not appear on either your credit card or bank statements, meaning your online casino activities are anonymous and can’t be traced back to your bank or credit card statement.

Security: Using an Entropay virtual Visa card adds another security dimension to all of your online financial transactions, not least when dealing with an online casino. This is because you’re only required to share your Entropay card number with the casino, not any of your other bank or financial details. As a consequence, your financial data is completely secure with no data sitting on the casino’s servers. Additionally, all of your transactions at Entropay, whether depositing or withdrawing funds are protected by 128-bit SSL encryption.

Speed: Speed is another incentive for using an Entropay card. Anyone who has transferred funds using direct bank transfer will be aware of how long this can take, whether you’re moving money domestically or overseas. However, payments with Entropay are immediate, so there’s no waiting around for funds to clear.

Bankroll Management: As Entropay is a pre-paid debit card rather than a credit card such as VISA, you have more control over your expenditure. Any money you deposit into a casino account is ‘your’ money and not money on credit. For those who like to keep a close eye on their bankroll, or like to set themselves clear limits as to how much they deposit, this is the ideal solution as you can only spend money which is yours, not the bank’s (although there is the option to get an Entropay MasterCard ‘plastic’ credit card, if you think that would better suit your needs).

No credit checks: As Entropay is a pre-paid, virtual Visa card there is no need for credit checks. This means not only that you can get a card irrespective of your credit record, but also that there is no delay between applying and receiving your card. Simply apply online and your virtual card is with you straight away.

Multiple uses: Even if your primary purpose is getting an Entropay card is to make running your casino account easier, it’s not limited to this use – you can use your card to shop online at any store or service provider that accepts Visa cards, which means you’re actually getting a very versatile and convenient card that you can use in any number of ways. You can also access your Entropay account from any sort of device, from desktops to smartphones and tablets.

Accessibility: A further advantage is that money you withdraw from your casino account back into your Entropay account can always be accessed. So whether you want to withdraw that money to credit it back to your bank or credit card account, or use it for another online purchase, your funds are always available and instantly accessible.

Disadvantages of using Entropay

The main real disadvantage to using an Entropay prepaid virtual Visa card is the small fees incurred. While you won’t incur any charges at the top Entropay casinos we’ve listed above for transferring money from your Entropay account to your online casino account, there are nevertheless fees associated with loading funds to Entropay from your bank account or via credit card.

If you make a deposit to your Entropay account from a credit or debit card, there’s a fee of 4.95%, or 3.95% when you add funds using direct bank transfer. Third-party deposits into your account i.e., when you withdraw winnings from your online casino account, attract a fee of 1.95%. In addition, when you transfer cash from your Entropay account back to your credit or debit card there is a fee of $6.

However, for many players, these fees are more than outweighed by the convenience and added security of using Entropy as outlined above.

Transaction Type | Fees |

|---|---|

| Signing up | FREE |

| Create an Entropay Virtual VISA Card | FREE |

| Load Entropay card from credit/debit card | 4.95% |

| Transfer between Entropay cards | CAD $0.20 |

| Spend using Entropay card | CAD $0 |

| Return funds to personal credit/debit cards | CAD $6 |

| Destroy an Entropay card | FREE |

Setting up and funding an Entropay virtual Visa card

It is very quick and easy to set up an Entropay account, and once you’ve done so you can start using it immediately. There are no charges to set up an account, nor any annual fee or interest charges.

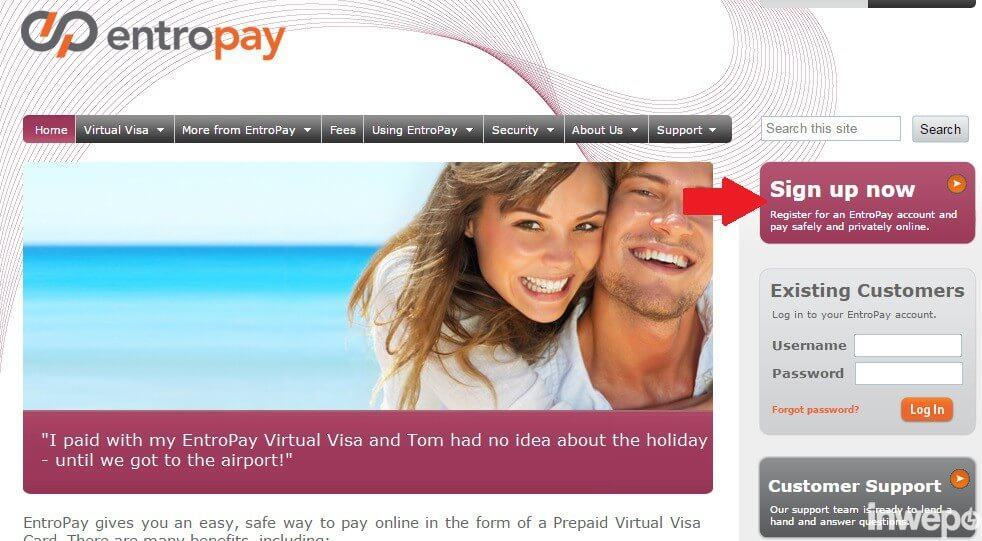

Go to www.entropay.com and click on Sign Up. You’ll then be asked to enter your name, email, date of birth and country of residence, and to create a username and password. Once you’ve done this, you instantly receive your 16-digit virtual Visa card number along with a 3-figure CCV number and, once funds have been deposited, this can be used straight away.

Once you have completed the above steps, loading money onto your account is similarly straightforward. You can choose to do this either via direct bank transfer or using a credit or debit card, with most major brands accepted. Anyone who has used internet banking, or made any sort of online purchase, will be able to accomplish this with ease.

How to deposit at an online casino using Entropay

Depositing funds at online casinos accepting Entropay will vary slightly from site to site, but generally speaking, the process is straightforward and runs as follows:

- go to Banking

- click on Deposit

- when presented with payment options, select Entropay

- follow the prompts (usually, Add Card, or Add Another Card)

- register your card by entering your 16-digit virtual Visa card number and 3-digit CCV (once you have registered your card for the first time, you won’t be required to do this again)

- enter the amount you wish to deposit

- click on Next to complete your deposit

The steps above are for those who have already set up their Entropay account. If this isn’t the case, you’ll be required to create your Entropay account between steps 3 and 4.

A cross between a credit card like and pre-paid card such as Paysafecard, Entropay offers secure, anonymous and instant payments making it a top way for Canadians to fund their online casino accounts. Click on the button below to start playing at a leading Entropay accepting casino

PayPal is one of the original, and still de-facto e-money provider that allows you to send and receive funds at the click of the button.

If you’re based in the UK and you transfer money to friends or family that are also in the UK, then you won’t pay any fees to transact. This is also the case if you decide to withdraw funds to a UK bank account, as the process is free.

However, sending and receiving funds to somebody located abroad can be costly, as the fees PayPal charges for such a privilege are somewhat expensive.

It is also important to remember that not all online vendors favor PayPal as their primary e-money payment provider. As businesses themselves get charged fees to accept payments via PayPal, alternatives such as Skrill and Google Wallet are becoming more and more popular.

As such, if you’re looking for the best PayPal alternatives, be sure to read our guide. We’ll explain how each e-money provider works, alongside their respective advantages and disadvantages.

Skrill

Contents

Formally known as MoneyBookers, Skrill is by far the most popular alternative to PayPal. The UK company behind Skrill first launched its e-money service way back in 2001, making them one of the most established online payment processors in the industry.

The main overarching concept of Skrill is virtually identical to that of PayPal. Users create an account, link up a payment method such as a debit/credit card or bank account, deposit funds, and subsequently, send money.

Before you can start using your newly created Skrill account, you’ll first need to verify your identity. Much like in the case of PayPal, you might need to upload a copy of your government issued ID, and confirm a telephone number and email address.

In terms of fees, this can vary depending on where you are based. However, in the UK you will pay a 1% deposit fee when uploading funds to your Skrill account, and a fixed fee of EUR 5.50 (UK equivalent) if you decide to withdraw funds back to your UK bank account.

If you decide to withdraw money back to your VISA debit card, you’ll pay a remarkable 7.5% in fees. Skrill will also charge you a 1.45% transaction fee when sending funds to another user, although receiving money is free. All in, the fees charged by Skrill are significantly higher than that of PayPal.

Read our full review of Skrill.

TransferWise

If you’re looking to send and receive money overseas, or you’re looking to transact in more than one currency, then TransferWise is potentially the best option for you.

For example, while multi-currency transfers via PayPal can cost anywhere between 3-11.4%, TransferWise averages about 0.5% for most major currencies.

TransferWise is also notable if you want to send or receive money to a bank account. Although the payment provider acts as a third party intermediary between the two banks, the process is nothing short of excellent.

In most cases, transfers are received in less than an hour, with the receiver paying very little in terms of fees. This makes it ideal if you work as a freelancer and you need your international clients to pay you in the fastest and cheapest way possible.

Read our complete Transferwise Review

Google Pay

Google Wallet is an alternative to PayPal that allows you to seamlessly send and receive funds via your mobile phone. One of the stand-out advantages of Google Pay is that the provider does not charge you to fund transactions with a debit or credit card, nor does it cost anything to deposit via a bank account.

This makes Google Wallet stand out from the likes of Skrill or PayPal, who are both known to charge excessive fees.

Users of Google Wallet can also have a physical pre-paid card sent to them. This allows you to use your Google Wallet balance to pay for goods and services in-store, or even withdraw cash from an ATM.

The only down-side to the Google Wallet app is that significantly fewer merchants accept it in comparison to PayPal, and even Skrill. However, as Google Wallet is much more favorable for online stores, at least in terms of fees, expect the provider’s market share to increase over time.

Finally, although Google Wallet is a direct competitor to the Apple Pay e-money service, iOS users can still download the app via the iTunes Store.

Entropay Alternative Us

Neteller

Originally based in Canada before relocating to the Isle of Man in 2004, Neteller is an e-money provider that performs a similar function to both PayPal and Skrill. The provider has excellent exposure in the online marketplace, meaning that you have plenty of choice if you’re looking to use your Neteller funds to buy products or services.

Neteller allows you to fund your account with several different payment methods. This covers popular payment channels such as Visa and Mastercard, as well as unconventional methods such as Bitcoin and GiroPay.

Most funding methods carry a deposit fee of 2.5%, which is quite expensive. If you want to withdraw your money out of Neteller, you’ll pay a $10 fee if opting for a bank transfer.

Although using your Neteller balance to buy goods online is free, money transfers cost 1.45% per transaction, plus a fixed fee of $0.50. If you need to transact in more than one currency, then you’ll need to pay an additional 3.99%.

This can make cross-border transactions very expensive, especially when you add on the standard transaction fee of 1.45%

Entropay

If your main objective is purchase goods and services online without exposing your debit or credit card details, then Entropay is one the best PayPal alternatives out there. In the nutshell, the Maltese-based company allows you to create an unlimited number of virtual credit cards (VCCs). The name VCC can be somewhat misleading, as they are actually pre-paid debit cards as opposed to credit cards.

Best Entropay Alternative

Nevertheless, once you register an account and verify your identity, you’ll be able to use your personal debit/credit card or bank account to deposit funds. The only issue with Entropay is that you’ll need to cover a rather hefty 4.95% deposit fee when you upload funds.

However, once you’ve loaded your account, you can create a new VCC and subsequently use it in the same way that you would a traditional bank card. The cards are backed by the Bank of Valletta, and issued by MasterCard.

Payoneer

Alternative To Entropay

Launched in 2005 and headquartered in New York, Payoneer is a payment services provider that allows users to send and receive money online. The platform currently services more than 4 million customers located in more 200 countries.

When it comes to fees, Payoneer charge 1% to upload funds to your account, which is a lot cheaper than many of the other PayPal alternatives on our list. The good news is that if you use Payoneer to transfer funds to a bank account, you pay nothing apart from the fees charged by the receiving bank.

Cross-currency transactions cost in the region of 2% above the mid-market rate, although this can be lowered if you hold a VIP account. If you obtain the Payoneer pre-paid debit card, then you’ll pay $3.15 per ATM withdrawal.

Payoneer is also a notable PayPal alternative due to its highly rated customer support. You have the option of contacting support via telephone, live chat or through a support ticket. However, response times are somewhat slow over the weekend, so you’re best off calling them if your query is of an urgent nature.

Venmo

Venmo was launched in 2009 and is owned by PayPal. The online payment provider adds a personal touch to transactions, which makes is great if you want to send or receive money to friends and family. The great thing about using Venmo is that you won’t be charged to upload funds via a bank account.

However, if you want to transact using your credit card, you will pay a 3% fee. This is standard for most credit card deposits in the e-money space, as providers cover their backs in the case of a charge-back.

Although Venmo is great for its fast transactions and reasonable fees, it’s not really suitable for freelance payments or supplier invoices as the app is intended for transferring cash between family and friends.

Best PayPal Alternatives: The Verdict?

In summary, although PayPal is one of the most popular e-money providers in the industry, there are some highly notable alternatives to consider. The PayPal alternative that you go with will ultimately depend on what you are looking for from an e-money provider.

For example, if you’re looking to regularly send and receive funds on an international basis using multiple currencies, then your best bet is likely to be TransferWise. Alternatively, if you want an e-money provider that charges the lowest fees, then Google Wallet is probably the most suitable, not least because they do not charge anything to transact.

Whichever PayPal alternative you do decide to use, just make sure that you have a full understanding of the underlying fee structure. Certain fees, such as account inactivity charges, are often not clearly stated, so ensure you do lots of research before signing up.